Medical Loans in Singapore | Pay Your Medical Bills Fast

Convenient online application

Instant loan approval

Affordable interest with flexible repayments

Trusted since 2009

Let our medical loan help with your medical bills today.

What is a Medical Loan in Singapore?

A medical loan in Singapore is a type of personal loan you can use to pay for urgent medical procedures that you or a loved one needs. Medical loans are unsecured, which means no collateral is needed when applying for one.

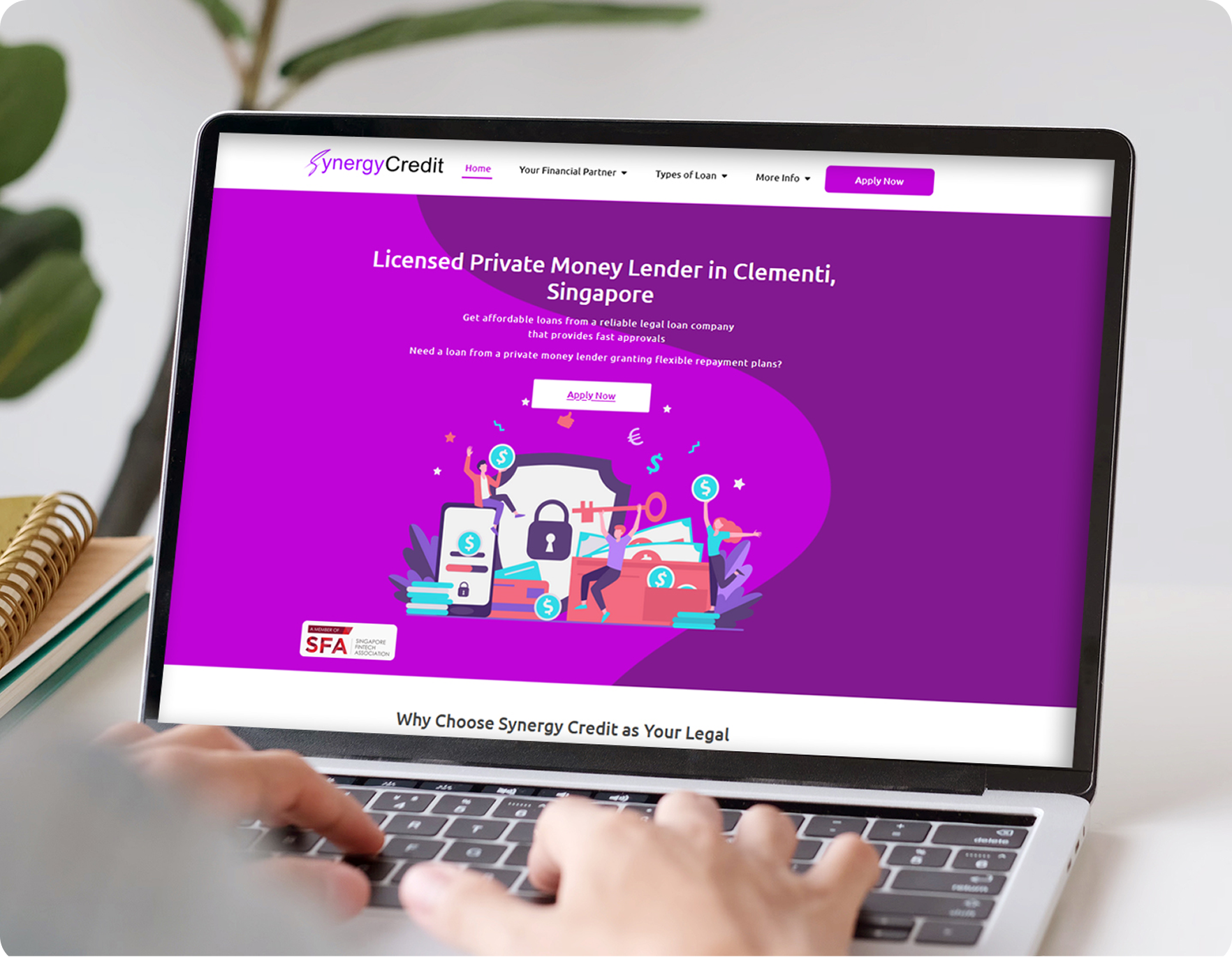

You can apply for a medical loan from a licensed money lender such as Synergy Credit, which offers a convenient online application and fast loan approval in under 20 minutes. As our focus is to help you pay your medical bills with minimal stress, our medical loans come with affordable interest rates and flexible repayment schedules.

Loan for Medical Treatment: Let Us Help You in Times of Need

Get the funds you need fast

No stringent credit checks required, all borrowers may apply

Versatile finance for medical procedures; pay for any procedure, including outpatient treatment

Gain peace of mind and focus on recovery

Uses of a Medical Loan in Singapore

Inadequate Medisave

- When your Medisave is insufficient to cover your medical bill

- When you have hit the annual withdrawal limit on your Medisave account

Not covered by Medishield

- When you have to pay for medical costs not covered by Medishield, such as ambulance rides

Insufficient or no insurance

- When you do not have sufficient insurance coverage to pay off your medical bills

- When your loved one is uninsurable due to pre-existing conditions or old age

Lack of savings

- When you have run out of savings to pay for continued medical treatment

Loss of income

- When hospitalisation stops you from earning an income

- When you’re unable to work due to long recovery or a long-term injury

Need urgent treatment? Get your low-cost loan for medical expenses from us today.

Our Simple 3-Step Process

Swift Online Application

Fill out the loan application form.

Await Your Application Status

We will reach out to you ideally on the same day, followed by a short face-to-face interview to understand your needs and discuss your repayment plan.

Receive Your Funds

Upon signing the contract, we’ll disburse the funds to you either in cash or PayNow immediately.

Commonly Asked Questions — Medical Loans in Singapore

Are medical loans unsecured or secured loans?

Medical loans in Singapore are classified as unsecured personal loans. As such, a borrower does not require collateral when applying for a loan for medical procedures or a loan for medical bills.

Where can you apply for a medical loan in Singapore?

Due to how popular they are, there are several places where you can obtain a medical loan in Singapore. Given our stellar reviews, fast approval, affordable interest rates, and flexible repayment schedules, licensed lenders like Synergy Credit are a trustworthy choice for medical loans.

We also do not require stringent credit score checks, so your credit history need not be a barrier to getting your medical loan. You can conveniently apply for a medical loan online at our website. Simply complete the online form or use the Singpass Myinfo option to speed up the process — our friendly team will get in touch with you asap!

How much are you permitted to borrow when taking out a medical loan from us?

How much you are allowed to borrow for a medical loan is dependent on your income and your residency status.

| For Singaporeans and PRs | For Foreigners |

|---|---|

|

|

What documents should I prepare when getting a medical loan with Synergy Credit?

When getting a medical loan, take note that you will need to provide the following documents:

-

Personal identification, such as NRIC, Employment Pass or S-Pass

-

Proof of income, such as CPF statements, income slips, bank statements, etc

-

Proof of residency, such as a bank statement showing your address (for foreigners only)

Note that you may be asked to provide other supporting documents when applying for your medical loan. Questions? Contact us to clarify the required documents or any other questions you may have.

Does Synergy Credit charge any early repayment penalty if I pay off my medical loan early?

No, Synergy Credit does not require you to pay any early repayment penalty if you were to repay your medical loan ahead of schedule. In fact, the earlier you pay down your loan, the less interest you’ll need to pay overall. Thus, we encourage you to repay your medical loan as soon as you can.

Ask us about our flexible repayment terms and learn how they can benefit you.

Does Synergy Credit offer medical loans to people with bad credit?

At Synergy Credit, we offer medical loans to all borrowers, even those with bad credit. As a matter of fact, we do not evaluate your loan application solely based on your credit history. Thus, if your credit standing is bad, rest assured, it will not prevent you from getting a medical loan from us.

What are the typical interest rates of medical loans in Singapore?

For medical loans in Singapore, licensed lenders charge an interest rate between 1% and 4% per month. Speak with us to discuss a medical loan package tailored to your needs and circumstances.